Why

Existing smart contract bridge designs suffer variously from centralization, poor safety guarantees, fragmented liquidity, latency and chain reorganisation risk. Layer Cake is designed to be a fast, more secure cross-chain bridging approach that unifies liquidity and mitigates chain reorganisation risk.

How

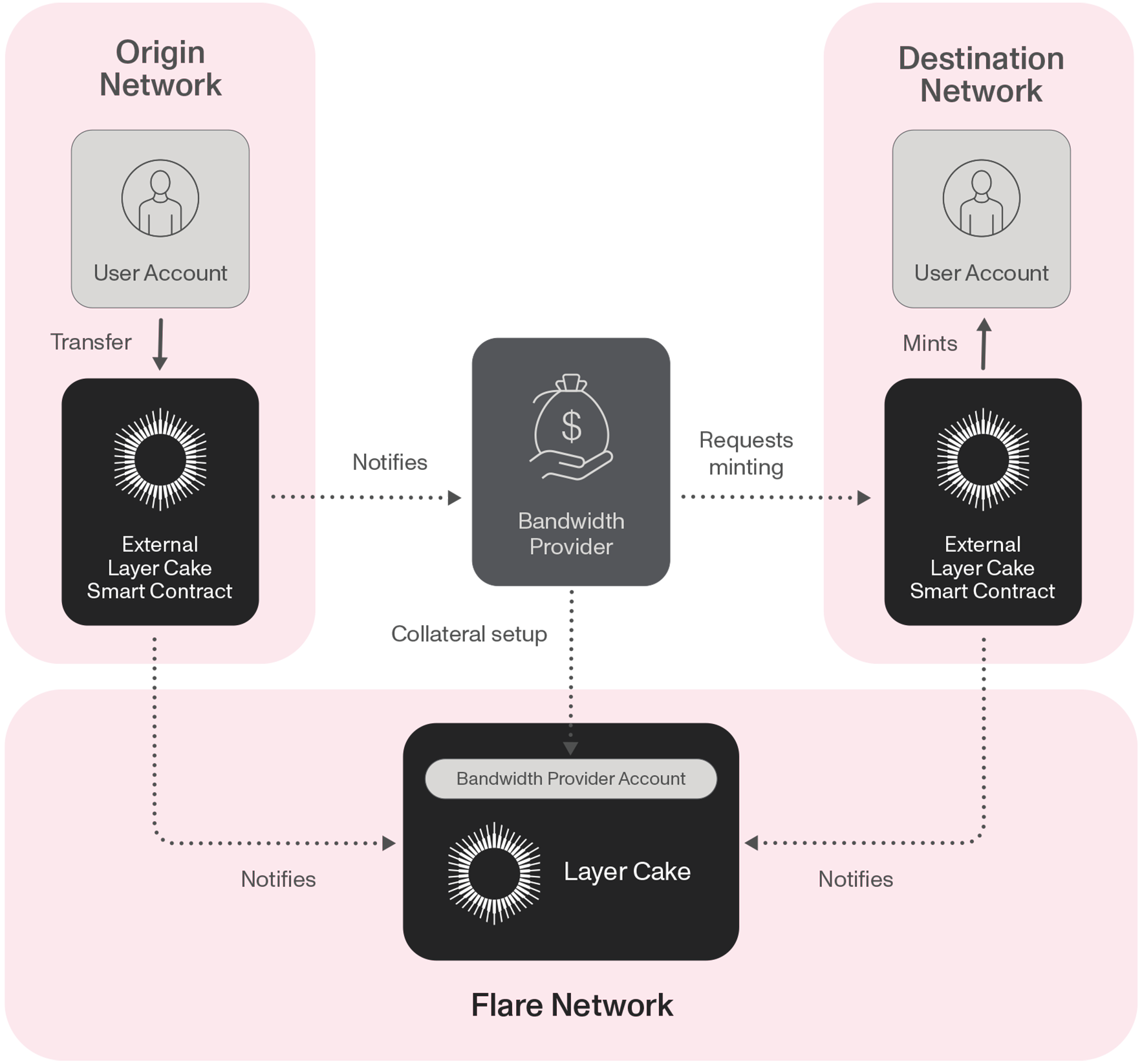

Layer Cake secures each bridging event with 1:1 collateral in the same currency that is being bridged. Once the crossing is complete and the wrapped asset is in the user’s account, the collateral is unlocked, ready to be used in another crossing. For this reason this collateral is termed “bandwidth”, because it dictates how much value can move across the bridge at any one time and its existence renders Layer Cake trustless.

The collateral securing bridging comes from the bridge’s operators, who are called Bandwidth Providers. They take a small fee from each transaction that they secure. Bandwidth Providers cannot trigger a bridge transaction for a value higher than the amount of collateral they have locked. Additionally, Bandwidth Providers put up a second identical amount of collateral to cover the chain reorganisation risk.

The amount that can cross the bridge at any one time is dictated by the total bandwidth held by the bridge. Like physical bridges, Layer Cake bridges can handle any amount of “traffic” flowing across them over time; they only restrict the amount of traffic that can transit simultaneously. They can also handle any amount across the bridge with a suitable delay for safe cross chain communication, regardless of how much bandwidth is available.

Fast, decentralized, multilateral, insured

bridging for smart contract tokens.

Fast, decentralized, multilateral, insured bridging for smart contract tokens.