Why

According to CoinGecko, almost 70% of the total value of blockchain assets is currently unable to participate in the decentralized economy. By minting these non-contract tokens into FAssets on Flare they can be put to work earning yield or rewards in decentralized applications on the Flare network, including; DeFi, NFT’s, fast payment and the Metaverse. They will also be able to be bridged onto other smart contract chains using Flare’s Layer Cake bridges.

How

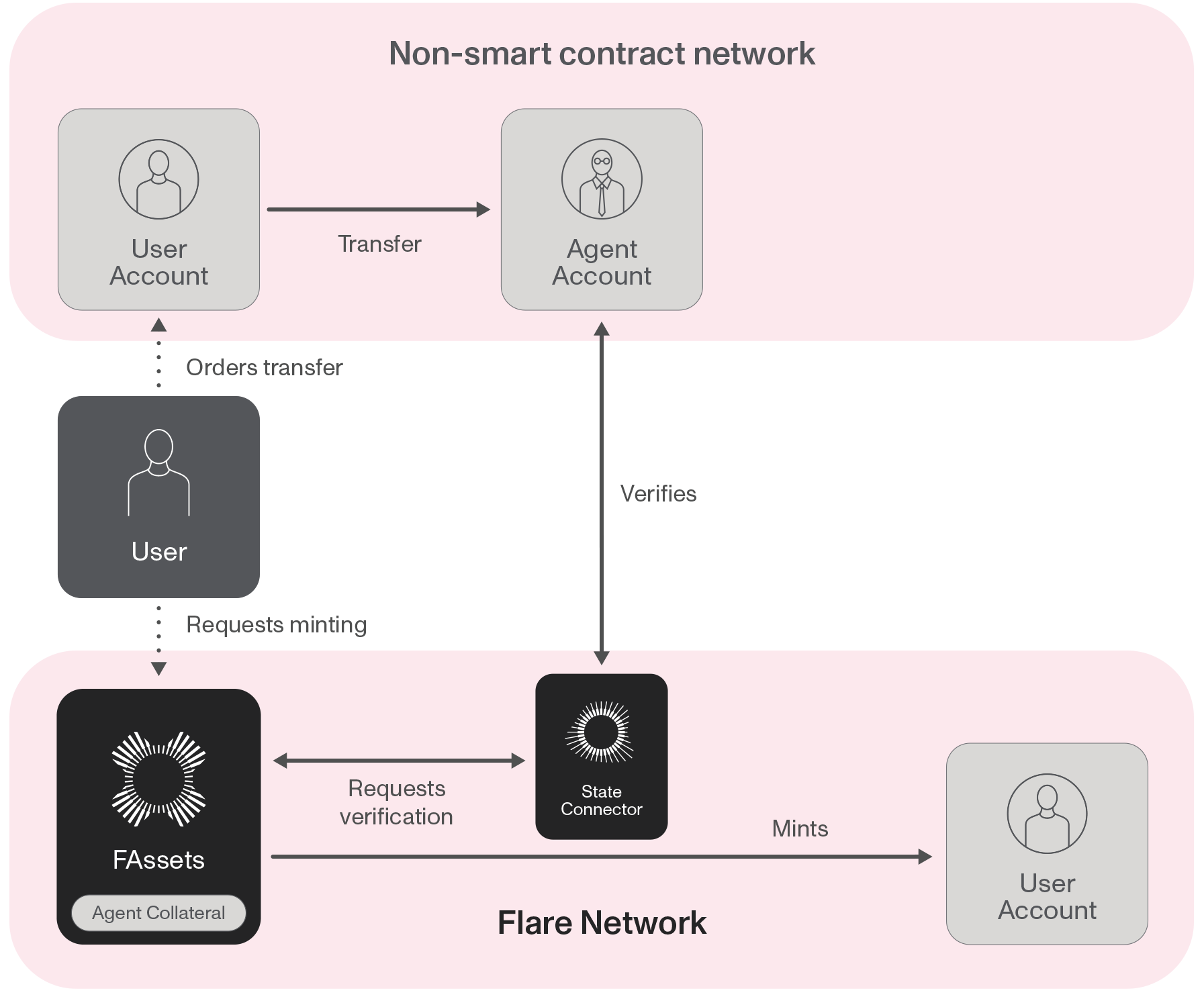

An Agent receives an underlying asset such as XRP or Bitcoin from a user who wishes to mint an FAsset (called the minter) in this case it could be FXRP or FBTC. Upon receipt by the Agent, the minter receives FXRP or FBTC on Flare. They can then use these tokens with smart contracts on Flare, or other chains through bridging with Layer Cake. The Agent’s role in the system is secured through over-collateralization, such that the system is rendered trustless.

When a minter wishes to redeem an FAsset for the underlying, the system assigns a redemption request to an Agent. Upon receipt, the Agent has the obligation to send the original underlying asset (FXRP or FBTC in this example) back to the minter, and the Fasset is destroyed.

For security and to account for market volatility, the system ensures the amount of collateral locked is consistently of greater value than the FAssets that are minted.

FAssets are powered by Flare’s native interoperability technology: The Flare Time Series Oracle (FTSO) provides decentralized price data for each underlying asset, and the State Connector is able to trustlessly and securely prove that assets have been transferred on the origin chain.

FAssets enable smart contracts for tokens without them.

FAssets enable smart contracts for tokens without them.